Claims Upload

Claims Upload was the first initiative of LV= digital transformation of customer facing claims journey.

With Claims Upload the Claims Centre is able to streamline the claims process, enhance the operational efficiency and improve customer satisfaction, ensuring accurate, timely claims processing.

The solution was initially created to support Motor policy claims mainly due to large volumes of Motor claims being initiated on a daily basis. It was later rolled out to Home claim policies as well.

My Role in a Nutshell

I was hired as the Digital Product Owner to deliver the Claims Upload product from inception to launch, continuously improving the customer journey and collaborating with the Claims department to create robust, secure and engaging customer-facing digital experiences.

The digital development team included a Scrum Master, a front-end developer, and two test analysts responsible for both manual and automated testing. Additionally, Claims engineers, a Business Analyst, a Project Manager, a Technical Project Manager, a Solution Architect, a Technical Architect, Mule back-end engineers, and infrastructure engineers were allocated as shared resources based on demand and availability.

The solution incorporated two third-party services: one for generating and delivering SMS notifications to customers and another for scanning submitted evidence for viruses and malware before transferring data to the data centres.

As the Product Owner, I closely collaborated with stakeholders and the project sponsor from the Claims department, the Business Analyst, the Technical Project Manager as well as user researchers, content writers, and designers from the Digital department, to craft a seamless end-to-end customer journey.

Working in close partnership with the Scrum Master and various cross-functional teams, I coordinated activities and deliverables to ensure a robust, secure and reliable back-end solution and an intuitive, user-friendly customer interface. This collaborative approach resulted in a streamlined, efficient experience for our customers as well as the Claims operations team.

Here are some of the key activities I performed to drive the initiative:

The Problem - Issues and Challenges

Here are some key challenges faced by the LV= Claims Centre:

Pain points for policyholders:

- Gathering and providing the necessary evidence and documentation is time-consuming and burdensome.

- Lengthy and intricate evaluation processes frustrate policyholders.

- Technicalities and missing information often result in claim denials or delays, causing stress and uncertainty for policyholders.

- Managing and analysing a large volume of claims efficiently is challenging.

- Handling claims with missing or incorrect information delays processing.

- Submissions with poor-quality evidence or incompatible formats complicate the assessment process and cause delays.

- Verifying the authenticity of submitted evidence is both challenging and time-consuming.

- Identifying and preventing fraudulent claims is difficult, impacting the company’s financial health, operational efficiency, reputation, regulatory standing, and customer satisfaction.

Goals & Objectives

To address these challenges, both the Claims and Digital departments formed a dedicated project team to develop an innovative solution, resulting in enhanced efficiency, accuracy, and overall effectiveness of the claims process.

The following goals were set to be achieved:

- Speed up the claims process by removing bottlenecks and manual efforts in receiving and preparing evidence.

- Reduce fraudulent claims by using automated tools to verify the authenticity of the evidence.

- Implement user-friendly online portals for policyholders to upload evidence directly, ensuring completeness and accuracy.

- Provide a simple intuitive customer journey with clear guidelines and checklists for policyholders to ensure they submit all required evidence correctly.

- Standardise the format and quality of evidence submissions to facilitate easier and faster analysis.

Strategic Vision

Revolutionise the claims process by providing a seamless, efficient, and user-friendly digital solution that empowers the policyholder to quickly and easily submit evidence of claims, enhancing the accuracy and speed of claim processing, and ultimately improving customer satisfaction and trust in our services.

Key Benefits

By automating the evidence submission process, Image Upload delivers value to both customers and the company.

- Faster claim assessments: Enables quick and accurate assessment of damages by allowing customers to upload images directly.

- Reduced processing time: Automates the initial stages of claims processing, reducing the time taken to settle claims.

- Enhanced customer experience: Customers can easily submit claims from their mobile devices or computers, enhancing their overall experience.

- Operational efficiency: Automates the collection and categorisation of claim-related images, freeing up resources and reducing manual labour. Minimises errors associated with manual data entry and documentation, improving accuracy.

- Reduced administrative costs: Lowers the need to handle and store physical documentation and mailing, cutting down administrative expenses.

- Decreased fraud: Helps in early detection of fraudulent claims by extracting and providing access to Claim Handlers the metadata of the evidence.

The Solution

The solution was initially developed to support Motor insurance claims. However, it was designed with versatility in mind, allowing for easy adaptation to accommodate any type of insurance claim with minimal modifications. This approach significantly reduces time to market and accelerates benefit realisation across various insurance sectors.

The Claims Upload product features a simple and intuitive web-based, mobile-first customer journey that seamlessly integrates with external applications FastSMS and Bluecoat, as well as the complex back-end systems of the Claims Centre.

The process begins when a customer reports a claim (First Notification of Loss) to the Claims Centre. The Claims Handler then creates a unique link tailored to the customer’s profile and generates an SMS through the system, delivered via FastSMS.

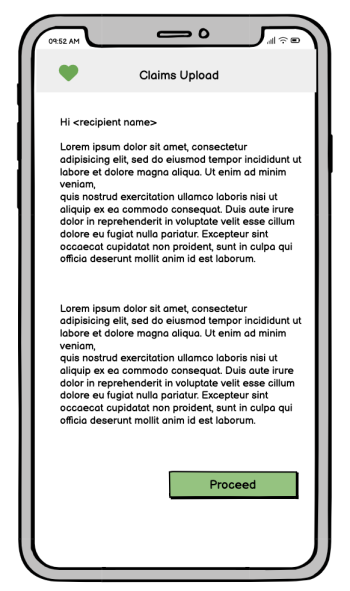

Upon receiving the SMS, the customer accesses the web-based application through the provided link and follows clear instructions to attach relevant images and documents. To ensure compatibility with the Claims Centre’s requirements, the application enforces file format and size restrictions on the attachments.

Once the customer submits the attachments, Bluecoat scans them for viruses and malware, ensuring security before transferring the files to the Claims Centre’s document management system via the Mule application.

Subsequently, the Claims Centre application generates a notification for the Claims Owner and places the submitted artefacts in the assessment queue, ready for evaluation.

End-to-end customer journey

High-level architecture

Wireframes

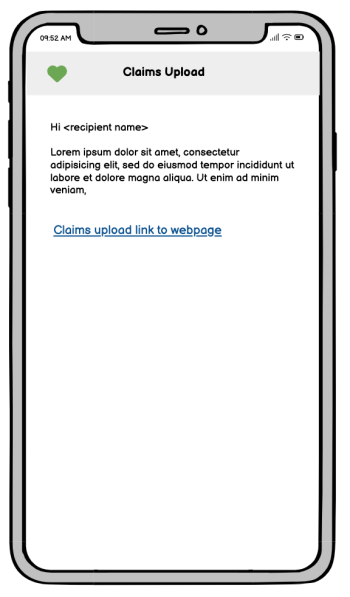

The customer receives an SMS with a unique link to the web application, allowing them to effortlessly upload artifacts such as images and documents. This link is specifically configured with the details the customer provided to the Claims Handler during the initial claim report.

Scale and Rollout Plan

The following enhancements were planned to extend the capabilities of the Claims Upload application:

- Roll out the Claims Upload functionality to Home and Personal Injury claims.

- Integrate the Claims Upload product into the MyAccount portal, enabling a self-serve customer journey for claims submissions.

- Provide complete transparency of the claims process through MyAccount, allowing customers to track their claims in real-time by integrating with 3rd parties such as repair shops, towing service providers, rental agencies etc to provide transparency.

- Create a Motor Total Loss customer journey that seamlessly incorporates the Claims Upload feature.