Payment Platform

The payments platform streamlines the payout process for Class Action Lawsuits (CAL) on behalf of law firms by integrating with third-party applications such as Direct ID, Experian, Apply Financial, and Comply Advantage. These integrations enable seamless onboarding and verification experience for customers. The platform then processes the payments, ensuring fast and secure payouts to customers via ClearBank.

By providing a seamless and frictionless experience, the platform enhances customer satisfaction and operational efficiency.

My Role in a Nutshell

As the Product Manager of the front-end development team, I led a remote team comprising in-house and offshore engineers, along with two test analysts, including a test automation specialist. Operating within an Agile framework, our team built product increments through two-week sprints. I spearheaded the Scrum team, overseeing sprint planning, backlog refinement, and sprint review sessions, while actively participating in daily standups and team retrospectives.

A critical aspect of my role was crafting user stories with clearly defined acceptance criteria and maintaining a prioritised backlog to deliver the roadmap to achieve the company’s strategic objectives. I collaborated closely with business stakeholders from FinCrime, Finance, and Customer Services teams to gather requirements for the new fully integrated platform.

By working hand-in-hand with the design team, I ensured that the user experience aligned with business requirements, developing the end-to-end customer journey and conducting usability tests with participants from stakeholder teams.

Providing strategic direction to the engineering team was another pivotal responsibility. I facilitated priority and trade-off decisions, and negotiated requirements with stakeholders to deliver a solution that was both business-viable and technically feasible.

Managing dependencies among three teams responsible for delivering the onboarding experience, integrating three AML/KYC verification processes, and a digital banking solution into the core platform was both complex and challenging. I collaborated closely with the Product Managers of other teams, serving as the product lead orchestrating the entire onboarding journey and delivering a cohesive end-to-end user experience.

The Problem - Issues and Challenges

The current onboarding processes and controls are fragmented across multiple standalone systems, resulting in significant inefficiencies and operational challenges. Limited integration between existing technology platforms necessitates manual data extraction and loading, which hampers workflow efficiency and increases the potential for human error.

The over-reliance on spreadsheets and shared file drives leads to bottlenecks in FinCrime operations, as analysts’ time is consumed by labour-intensive manual processes.

Furthermore, data and information are stored in silos across various systems and databases, each with different formats and structures. This lack of integration and standardisation creates substantial obstacles in building a unified view, often requiring analysts to manually assemble data. This process is time-intensive, laborious, and unreliable, impeding the ability to efficiently monitor and manage onboarding and compliance activities.

Goals & Objectives

To address these challenges, the company required a comprehensive, integrated onboarding solution that streamlines workflows, reduces manual intervention, and ensures seamless data integration across all platforms.

This solution enable:

- Automated data integration: Automate the extraction, transformation, and loading of data to minimise manual processes and reduce the reliance on spreadsheets and shared file drives.

- Centralised data repository: Consolidate data from multiple systems into a unified, easily accessible repository, facilitating a single, reliable view of information.

- Enhanced operational efficiency: Free up analysts’ time from manual data handling tasks, allowing them to focus on core analytical and compliance functions.

- Improved data reliability: Ensure consistent data formats and structures, reducing the risk of errors and enhancing the reliability of our data-driven decision-making processes.

Key Benefits

- Increase operational efficiencies through automation of processes and access to a single source of truth of the data.

- Transform client experience by shortening the onboarding time.

- Reduce compliance risk and manage compliance by improving reporting capabilities, accuracy and quality of data.

Strategic Vision

Product vision

- Create a seamless, secure, and efficient onboarding and payment platform that ensures timely and accurate contingent payouts, providing our clients and claimants with transparency and peace of mind throughout the entire process.

Product strategy

- Increase operational efficiencies through automation of processes and access to a single source of truth of the data to reduce manual intervention, minimise errors, and speed up processing times.

- Transform client experience by shortening the client onboarding time.

- Reduce compliance risk and manage compliance by improving reporting capabilities, accuracy and quality of data.

- Develop real-time monitoring and reporting tools to provide transparency and immediate issue resolution.

The Solution

The payment platform was designed to provide consistent, secure, and reliable payee verification services and process Class Action Lawsuit (CAL) payouts at scale. This robust, multi-currency platform automates payment processing, supports seamless straight-through processing, handles high transaction volumes, and operates cost-effectively.

This platform enhances operational efficiency, reduces manual interventions, and ensures that processes are resilient and scalable.

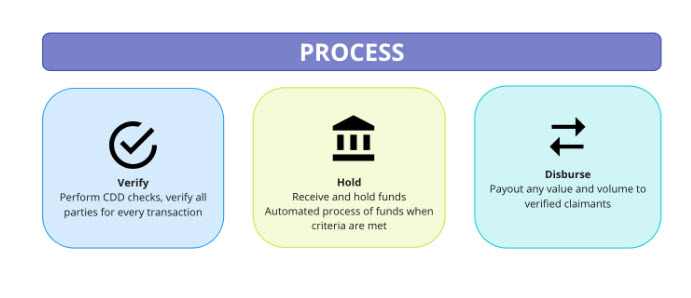

The end-to-end process consists of 3 main components; Verify, Hold and Disperse.

Verify

Shieldpay reaches out to claimants via email, inviting them to an onboarding journey that captures the necessary personal and/or business details, which are then validated and verified with DirectID open banking solution or Experian, Comply Advantage and Apply Financial external solutions.

Upon successful payee verification, Shieldpay instructs the law firm to authorise the verified claimants and reconcile the payments. Once reconciled, the law firm signs off to release the funds.

Hold

Disburse

Minimum Viable Product (MVP)

Following scope was agreed with the business stakeholders as the 1st iteration of the end-to-end payment solution.

High-level payee verification journey

High-level eved-to-end user journey map

High-level roadmap

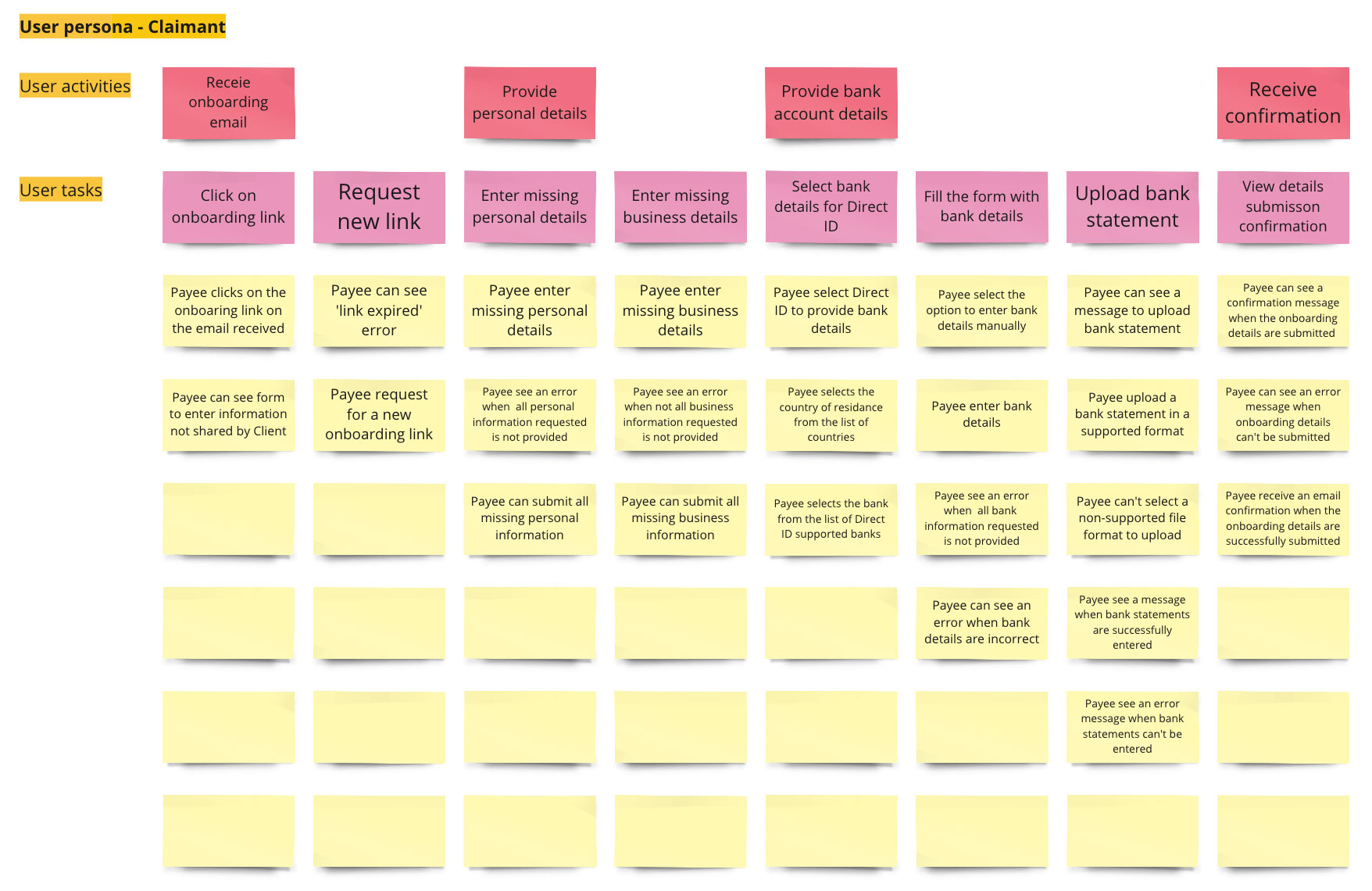

User story map

Following scope was agreed with the business stakeholders as the 1st iteration of the end-to-end payment solution.